ValuSource’s Mergerstat Review Premiums and Discounts database is an annual summary of industry statistics on mergers and acquisitions. The data comes from FactSet’s Mergerstat Review, which tracks acquisitions of 100% ownership of a company’s common equity. Open market stock purchases, new equity investments, private placements, new joint ventures, asset swaps, and real property are not recorded.

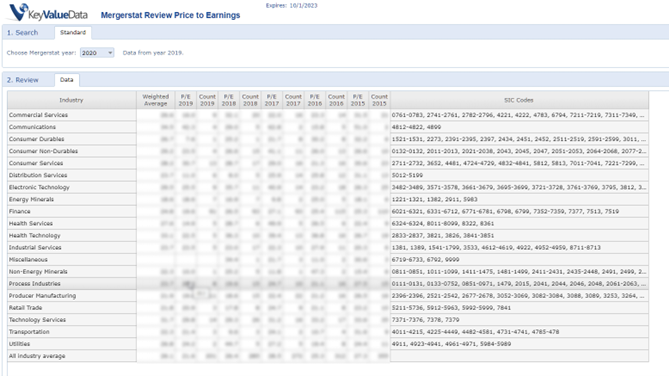

Data is grouped into twenty industries and one “all” category. The number of transactions and average premium paid for the last five years is available to use as a proxy for a control premium. You will have access to the prior years of Mergerstat data that you have purchased as well.

You can access the database from KeyValueData.com or the valuation software. The industries covered and the data columns are shown below:

Using Mergerstat Review Premiums and Discounts

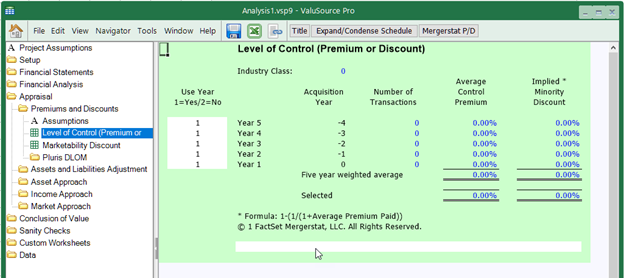

Mergerstat Review Premiums and Discounts allow you to download Mergerstat control premium data into Excel and ValuSource applications. The last five years of industry summary data are available as well as an All Industry Average. The premium is then converted to a minority interest discount using the formula 1 – (1 / (1 + control premium)).

Accessing Mergerstat Data in ValuSource Applications

The applications will automate the process of downloading and applying the data. You can download Mergerstat data into ValuSource applications, including BVM Pro, ValuSource Pro, and Express Business Valuation. The software automatically uses the data in the correct manner and in the appropriate schedules. The following screenshot shows one of the Mergerstat schedules in the software:

Click here to learn more about Mergerstat Review Premiums and Discounts.