- Discounts & Premiums

- Business Appraiser Databases

- See Bundles

- ADD TO CART

Pluris DLOM Database

Exclusively available from ValuSource

The Pluris DLOM is your best source of data for arriving at your discount for lack of marketability. Why? Because recent court decisions point to three key characteristics the courts like to see in the calculation of discount rates:

- Data drawn from restricted stock studies

- Data drawn from similar companies

- Data drawn from recent transactions

The Pluris DLOM is the largest restricted stock DLOM database available on the market today. It gives you the widest possible range of industries and company sizes. The data is updated regularly to provide you with the most recent transactions for your valuations.

Overview

The Pluris DLOM Database is constructed of data from restricted stock private placements transactions. But where other restricted stock transaction databases stop, the Pluris DLOM Database is just beginning.

Your discount, not someone else’s The Pluris DLOM Database is just that – a searchable database containing actual transactions in restricted stock and private placements. With this data your determination of an appropriate marketability discount for your valuation will be based on actual transaction data, not on some author’s opinion, or prior court cases, or a median value from a smaller study.

With over 4,400 transactions, Pluris DLOM has more than 10 times as many transactions as other commercial databases. How can the Pluris DLOM Database be so much larger than other commercial restricted stock studies? First and foremost, because the PrivateRaise data is simply more complete than any ad-hoc search of news on private placements. Finding, analyzing, and displaying private placement data is the main business of PrivateRaise, not just a part-time effort. And their data is relied on by deal makers world-wide in league tables, etc.

The Pluris DLOM Database includes both restricted stock transactions with and without warrants. Including these transactions with warrants not only increases the total number of transactions, but provides the appraiser with a much wider range of companies and industries to analyze. However, the search interface for the Pluris DLOM Database also allows the user to screen for only transactions without warrant coverage. This gives you more companies to choose from and increases the probability of finding companies appropriate for the fact pattern of your valuation. In addition, the continued expansion of the database backwards in time will provide an expanded universe of transactions for regression analysis and other statistical analyses.

Available in these bundles |

|||||

|

|

|

|

|

|

| SEE BUNDLES | ADD TO CART | ||||

A la Carte Pricing |

|||||

Single User$665 |

|||||

Multi User$1,065 |

Fresh transactions: The Pluris DLOM Database is updated regularly, so you always have the freshest available data to select from in developing your discount. Because the database is web-based, you don’t have to worry about getting the latest CD or downloading an update. The latest data is always at your fingertips when you sign on to the database.

More data: The Pluris DLOM Database contains over 80 data points for each transaction, including closing and announcement dates, market prices for the underlying stock on each date plus at set intervals before and after each date, industry descriptions and classifications, trading volume and volatility for each stock as well as the Chicago Board Options Exchange Volatility Index (VIX) as of each transaction date, details on any warrants issued with each deal, plus rich detail on the operating performance and financial position of each restricted stock issuer.

This level of detail is essential when selecting the transactions for developing your discount. In each private placement, the reference price determines the restricted stock discount. To get an accurate reference price requires an accurate transaction date. Without this, the analysis is fatally flawed. Because the Pluris DLOM Database is derived from deal-maker private placement data, we believe the transaction dates are highly accurate. In addition, with the wealth of data in the Pluris DLOM Database, you can determine how discounts change in response to changing economic conditions and to such economic indicators as the VIX, providing you with an even more accurate and defensible discount.

Transparency & Selection Method: The Pluris DLOM Database is backed by a methodology document which explains exactly which methods were used in constructing the database, down to individual search terms. Transparency means the analysis can be replicated – the cornerstone of the scientific method. That might come in handy someday in a Daubert challenge!

Moreover, the Pluris DLOM Database is constructed from widely used and respected data sources. The initial data selection comes from PrivateRaise, a service of DealFlow Media. PrivateRaise’s data on Private Investments in Public Equity (PIPEs), Shelf Registration Statements , Reverse Mergers and Special Purpose Acquisition Companies (SPACs) , is relied on by investment managers, banks, public corporations, law firms, and financial companies worldwide.

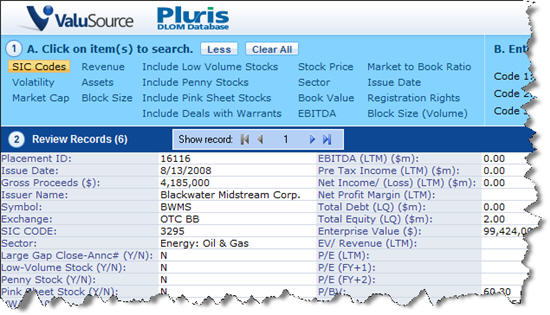

The search interface for the Pluris DLOM Database allows you to select transactions based on SIC codes, Volatility, market capitalization, revenue, assets and block size, plus twelve additional filter options.

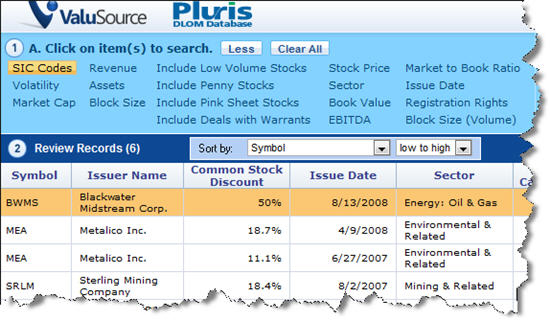

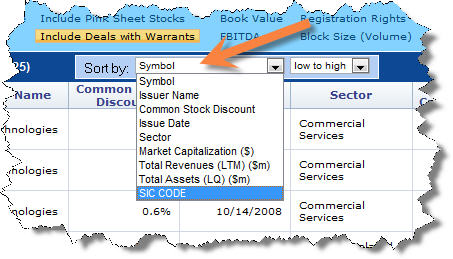

The search quickly returns a number of company transactions. You can click on any transaction for the details (as shown in Figure 1 above) of the transaction. You can also sort the transactions you have selected:

By adjusting the filters and ranges you select, you can change the transactions selected until you have the specific range of transactions needed.

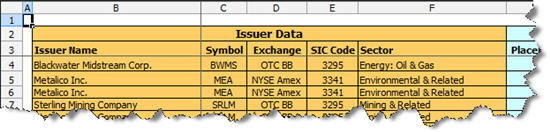

Then, a simple click on the Data button exports your data as an Excel spreadsheet with both a data and statistics tab, which you can now use to calculate the appropriate discount for lack of marketability for the subject of your valuation.”

Why Use the Pluris DLOM Database

You want your professional standard of care reflected throughout your valuation, including the development of the discount for lack of marketability (DLOM), not a median or a value copied from an outdated study by someone else. You want a legally defensible discount. The Pluris DLOM Database gives you the ability to select recent transactions in restricted stock on which to base your discount, with recent data from respected sources in sufficient volume and detail to inform your decision. In addition, the search criteria used to construct the database are completely transparent.